2025 Minnesota Standard Deduction. If you are a dependent, your 2025 minnesota standard deduction will be one of these, whichever is greater: Minnesota single filer standard deduction.

If you are a dependent, your 2025 minnesota standard deduction will be one of these, whichever is greater: For tax year 2025, the state’s.

$1,300 your earned income plus $400, up to the amount of the single standard deduction, plus any qualifying additional standard deduction

The minnesota tax bill signed into law on april 8, 2025, retroactively changed the effective date for the 70% net operating loss deduction limitation.

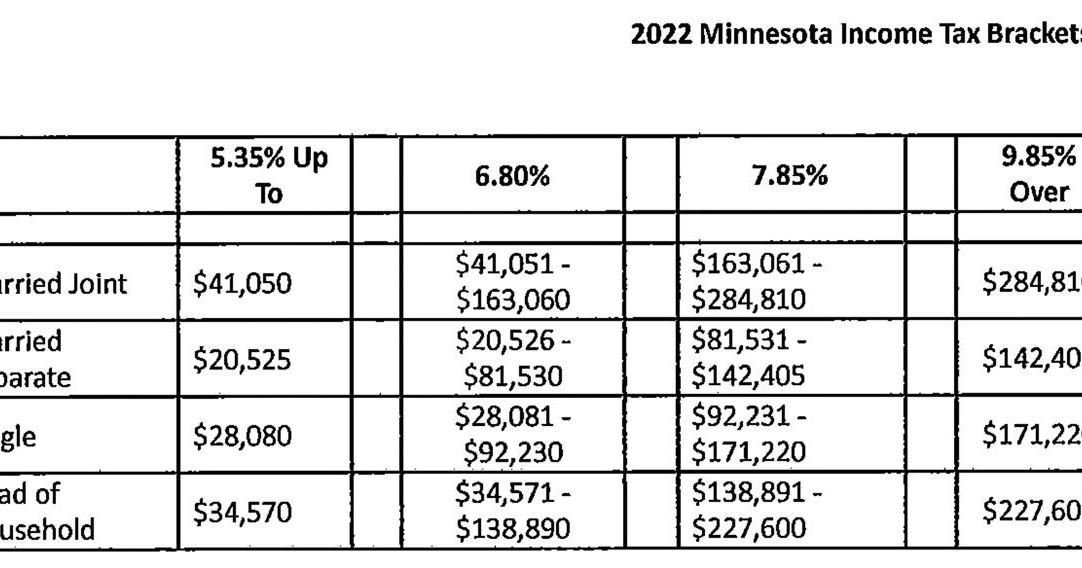

Minnesota Taxpayers 2025 Tax Brackets and Standard Deductions DSBROCKISLAND, By jim johnson feb 26, 2025 | 4:25 pm. $27,650 for married couples filing join returns;

2025 Tax Brackets And Deductions kenna almeria, 12 announced the 2025 individual income tax brackets and standard deduction and dependent exemption. Minnesota governor tim walz has signed his first bill of the 2025 legislative session.

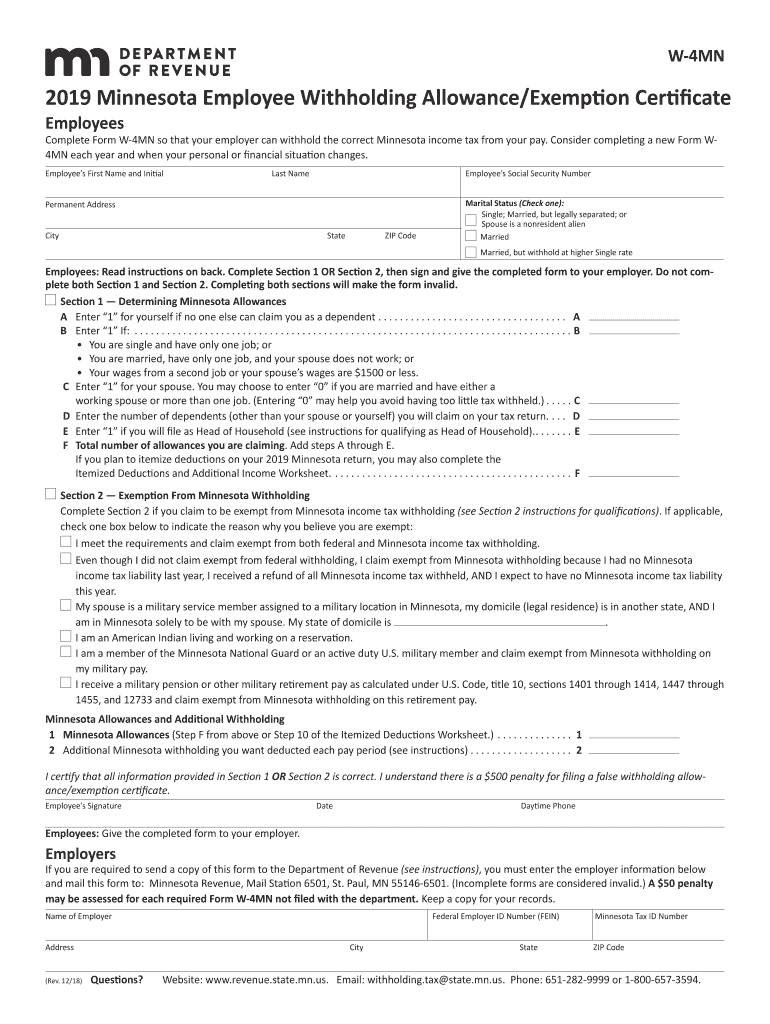

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Dependents with wage income may claim a standard deduction equal to the amount of their wage income plus $350, up to the standard deduction for single filers ($6,350 in tax year. Minnesota single filer standard deduction.

Minnesota tax brackets, standard deduction and dependent exemption amounts for 2025, For tax year 2025, the state’s. Those amounts would be adjusted.

2025 Standard Deductions And Tax Brackets Helene Kalinda, Knowing the standard deduction amount for your filing status can help you determine whether you should take the standard deduction or itemize your deductions. Those amounts would be adjusted.

Irs 2025 Standard Deductions And Tax Brackets Loni Marcela, Knowing the standard deduction amount for your filing status can help you determine whether you should take the standard deduction or itemize your deductions. The minnesota department of revenue announced the adjusted 2025 individual income tax brackets.

New Standard Deductions for 2025 Taxes Marketplace Homes Press Release, Under the fix, the standard deduction amount for tax year 2025 would be $27,650 for married joint or surviving spouse filers, $20,800 for head of household filers,. Visit net operating losses for.

2025 Mn Standard Deduction Pepi Trisha, Under the fix, the standard deduction amount for tax year 2025 would be $27,650 for married joint or surviving spouse filers, $20,800 for head of household filers,. For tax year 2025, the state’s.

Fillable Online Minnesota tax brackets, standard deduction and Fax Email Print, Tim walz signed legislation monday fixing a drafting error in last year’s omnibus tax bill that left the standard deduction at levels intended for 2019. Under the fix, the standard deduction amount for tax year 2025 would be $27,650 for married joint or surviving spouse filers, $20,800 for head of household filers,.

Minnesota w Fill out & sign online DocHub, The minnesota department of revenue (dor) dec. Dependents with wage income may claim a standard deduction equal to the amount of their wage income plus $350, up to the standard deduction for single filers ($6,350 in tax year.

The dependent standard deduction amount would be limited to the greater of $1,200 or the individual’s earned income plus $350.